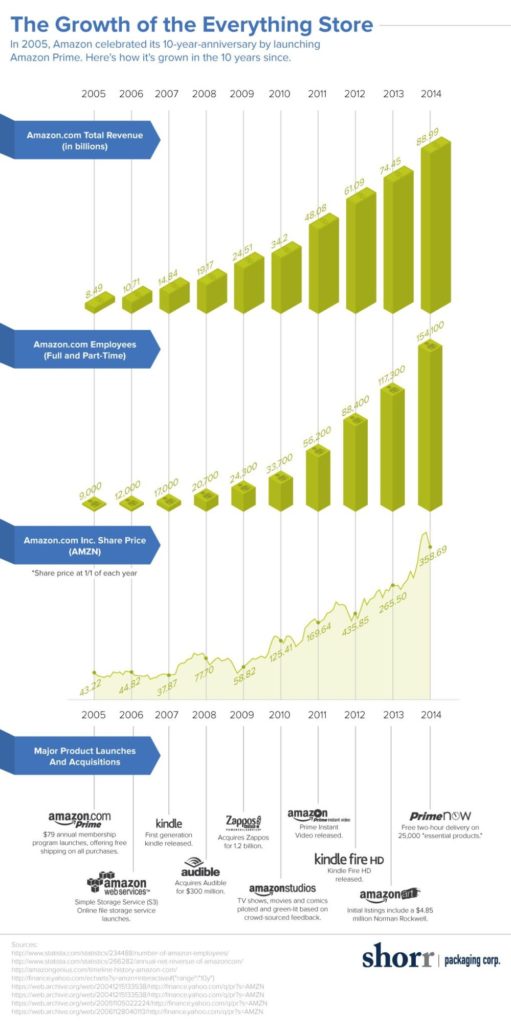

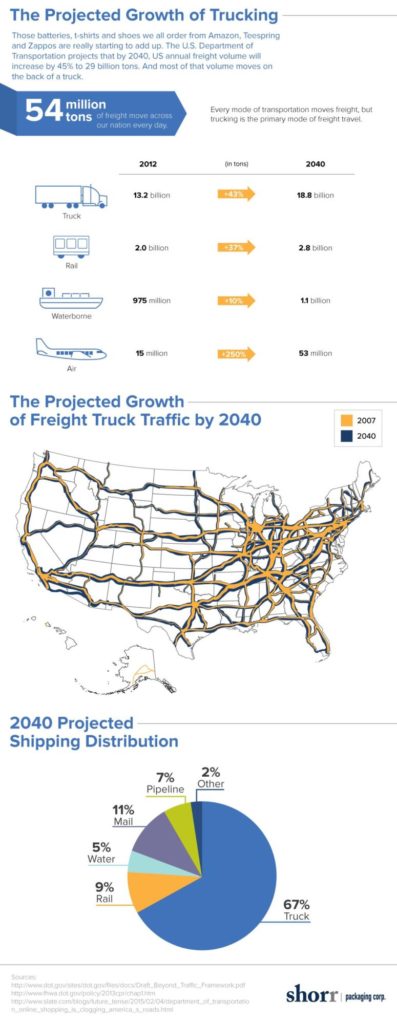

When it was first founded in 1994, Amazon.com was operating out of founder Jeff Bezos’ garage and earning $20,000 per week in sales within two months. Twenty-one years later, Amazon has 154,100 full-time employees and earned nearly $90 billion in revenue in 2014; and they’re widely known as ‘The Everything Store’, especially with Amazon Marketplace enabling sellers to offer new and used items alongside Amazon’s own products. Thanks in part to Amazon, e-commerce has exploded, and in doing so, it’s completely changed the way we shop, reshaping the U.S. economy in the process; in fact, according to a recent Department of Transportation study, online shopping (and the subsequent delivery process) will be a major contributor to the 29 billion tons of freight projected to travel on US roads every year by 2040.

For over 90 years, Shorr Packaging has worked with retailers and distributors, and in the last decade especially, we’ve come to work closely with e-commerce fulfillment businesses. In that time, we’ve seen firsthand the effect that e-commerce has had on the U.S. economy. In this piece, we’ll use Amazon as a vehicle to explore the impact of e-commerce on the U.S. economy, focusing on shipping, logistics, and the job market.

HOW AMAZON BECAME THE EVERYTHING STORE

Amazon began as an online book retailer, thanks to Bezos’ research that illustrated the worldwide demand for literature combined with the low price of books and the huge number of titles available in print. Gradually, Amazon expanded into selling CDs, DVDs, toys, electronics, and more.

After surviving the dot-com bubble bursting at the start of the 21st century, Amazon introduced Amazon Prime in 2005, a membership offering free two-day shipping on all eligible purchases for an annual flat-rate fee. Later Amazon Prime expanded to offering its members streaming media. In 2007, Amazon launched Amazon Kindle, an e-book reader, followed by a tablet computer called the Kindle Fire in 2011.

Amazon Prime, meanwhile, has also contributed dramatically to the company’s growth. In 2009, Amazon had 2 million Prime members, and in 2011, that grew to 5 million; in 2015, Prime membership is estimated to be around 40 million, and worldwide paid membership grew 53% last year. Even better for Amazon? Prime customers spend over double what non-Prime customers do- about $1,500 per year compared to about $625 per year.

One of Amazon’s most significant lasting impacts was their adoption of “free shipping” in the early 2000s, when they began their Super Saver Shipping program, offering free shipping for orders of over $25. During one promotion, Amazon began offering free shipping with the purchase of a second book, which lead to a huge jump in sales. Clearly, Amazon realized that consumer psychology favored labeling things as “free”; however, they might not have foreseen the effect free shipping would have on side industries such as shipping and logistics.

HOW ECOMMERCE HAS CHANGED SHIPPING

Shipping in the United States is currently seeing record highs, and many experts attribute this to the so-called “Amazon effect”. The result of increased purchasing of unpredictable sets of items from online retailers, the Amazon effect describes the need for the transport industries to adapt to Amazon’s practices.

For example, Amazon users can purchase an enormous variety of items, and they also sometimes have the option of purchasing seemingly random small items in addition to their main purchase in order to gain free shipping or other benefits. Shipping companies have to be prepared for these conventions and adjust to them accordingly.

The Amazon effect can also explain the increase in the American Trucking Associations’ trucking tonnage index, which was around 115 tons in June of 2005. The index hit historic highs over and around 130 in 2013 and 2014, with the only major dips occurring during the recession of late 2008-early 2009.

In 2012, the ATA predicted that by 2023, the total population of trucks in the U.S. will grow by 26%; the total miles driven will increase by 38%; and the total tonnage carried will increase by 26%. The trucking industry also foresaw a rise of nearly 66% in overall revenue, accompanied by a decline in rail tonnage and revenue to around 14.6% of the total transportation industry. Similarly, the U.S. Department of Transportation’s Federal Highway Administration forecasted a 44% increase in long-haul trucking tonnage from 2007-2040.

Of course, trucks have to be driven by someone, and with the increase in trucking tonnage and miles come an increase in employment opportunities.

THE IMPACT OF SHIPPING GROWTH ON THE JOB MARKET

In 1978, “truck driver” was the most common occupation in only nine states; today, it’s the most common occupation in 29 states. Employment of truck drivers is expected to grow 11% from 2012-2022.

This happens thanks to a few things. First, truck driving is immune to globalization and automation (you can’t outsource truck driving to India, and robots can’t yet drive cars); jobs that are needed everywhere have also moved up the list of most common jobs. Plus, the government categorizes truck drivers and delivery people into one large category, making it a very sizable occupation.

As the demand for truck drivers increases, of course, so does the amount of money needed to pay said truck drivers, as well as to cover other costs such as gas, truck maintenance, and more. Unfortunately for Amazon, they’re the ones paying the bill for all this “free shipping.”

For example, in Q3 2012, Amazon reported a loss of $636 million on shipping costs alone, thanks in part to having to absorb the shipping costs on orders that qualify for free shipping. To reduce this cost, Amazon has been progressively building more and more fulfillment centers in central transport hub areas. By creating more fulfillment centers, then, Amazon is able to cut down its shipping costs, since centers can be strategically placed near (and between) major population centers; customers also enjoy the benefit of packages being delivered more quickly. When deliveries require less mileage, the shipping industry can flourish at the local level.

However, while Amazon may be looking to cut costs on one side of this equation, these cost reductions represent a loss for organizations like UPS, FedEx, and the USPS. While e-commerce may have been a net boon for freight carriers to date, companies like UPS are grappling with shrinking margins, and the previously mentioned tendency of companies like Amazon to shorten their shipping routes through the use of ship-to-store and the opening of warehouses, lessening the costs of shipping. For example, Amazon lowered its shipping costs in Q1 2013 to 4.7% of revenue (from 5.1% a year earlier), thanks largely to the opening of warehouses which cut down on the length of shipping routes – a major means of determining costs for companies such as UPS and FedEx- and using its own delivery trucks.

However these fulfillment centers don’t run themselves, and they’ve also become major employers. Amazon has begun building warehouses closer to heavily populated areas like Los Angeles and San Francisco, using their growing fleet of delivery trucks to fulfill orders in these areas as well as Seattle. Today, most e-commerce orders start their journey in California, Ohio, New Jersey, Kentucky, or Tennessee. Together, these locations are able to deliver packages to the Western, Midwestern, Northeastern, and Southern United States. In fact, thanks to the growth of e-commerce, Shorr Packaging has opened distribution centers over the last few years in Atlanta, Dallas, Memphis, Phoenix and Tucson, Baltimore, Minneapolis and Los Angeles.

The rise of e-commerce has given rise to a range of new industries too, like “reverse logistics,” or companies that specialize in managing the shipping of returned items. The leader in this sector, GENCO (a Shorr customer), had an annual revenue in 2014 of $1.6 billion and around 11,000 employees- numbers which are expected to grow as more and more returns are carried out by individuals as well as B2B. However, as e-commerce grows, it also has an unavoidable effect on physical retail stores.

THE IMPACT OF SHIPPING GROWTH ON BRICKS-AND-MORTAR RETAIL

A consumer realizes that he needs to replace his coffee maker. He knows he has two choices: driving to a physical store and hoping that they have the model he wants, and loading it into his car and driving home, or searching online until he finds his preferred make and model at the lowest price available, and having it shipped directly to his home. Which one does he choose?

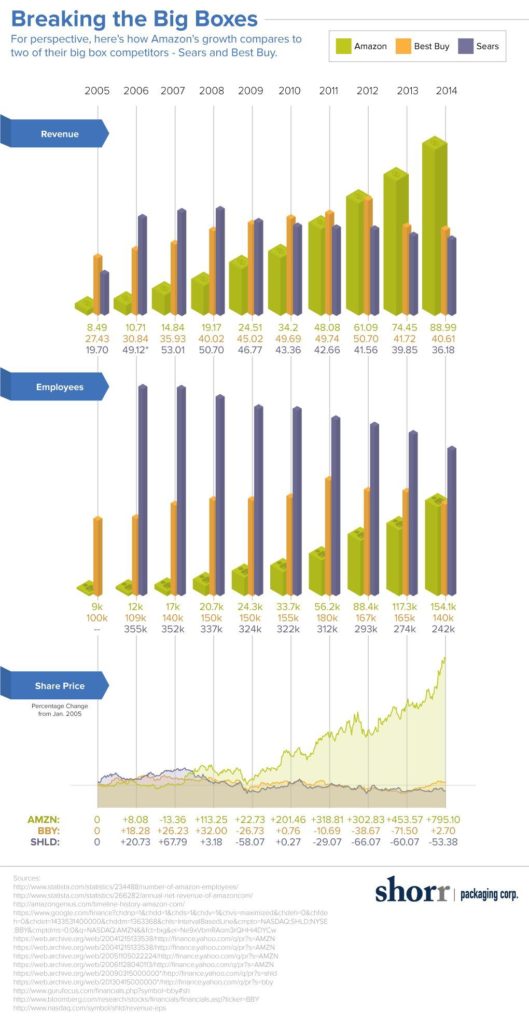

These days, our hypothetical consumer is becoming much more likely to choose the latter option. Thanks to online shopping, foot traffic, retail space openings, and holiday sales in retail stores have all decreased significantly. For some perspective, let’s compare Amazon’s e-commerce growth story to two of their big box competitors, Sears and Best Buy.

For example, brick and mortar retail stores have seen foot traffic cut by about 50% between 2010 and 2013, from more than 30 billion visitors during the holiday season to 17.6 billion visitors. Similarly, new retail space openings have been extremely low compared to years past, down to 43.8 million square feet in 2012, compared to more than 300 million in 2000, 2005, 2006, and 2007. Finally, online sales increased at more than double the rate of brick and mortar sales during the 2014 holidays; in fact, Shorr saw a 35% increase in business with e-retailers during the 2014 peak holiday season.

These trends have led to significant drops in revenue for some companies, and in some cases, even bankruptcy, with large companies such as Circuit City and K-B Toys experiencing total liquidation. And while the economy has added around 2.4 million jobs since the Great Recession, the retail industry has experienced a net loss of 60,000 jobs since the recession.

As an example of this trend, J.C. Penney’s stock has dropped 50% since the Great Recession, and holiday sales were down this year, a third from where they had been a year before, leading to an announcement in March that 20,000 jobs would be lost across the company. Some people speculate that the decline of similar big-box retail and department stores may be a harbinger of the fall of retail as a viable job market.

However there’s hope yet for bricks-and-mortar retailers looking to compete with the e-commerce industry, in that traditional retailers have locations all over the country. These locations are now being used by brands like Macy’s as ‘omnichannel distribution centers’, allowing retailers to ship to customers directly from a nearby store to cut down on lead times and reduce shipping costs- which is particularly important, given the introduction in January 2015 of dimensional weight pricing.

THE FUTURE OF THE AMAZON EFFECT

E-commerce shows no signs of slowing down, and it will continue to evolve. For example, e-commerce is expected to shift to marketplace selling rather than ordering directly from a retailer. Amazon’s latest numbers show that their third-party sales volumes grew by 100% in 2014 and currently account for 40% of total e-commerce turnover. Amazon’s marketplace benefits smaller sellers and manufacturers by connecting them with an enormous customer base and fulfillment program. However, even with these increases on the horizon, can e-commerce ever truly replace the in-person shopping experience?

One way that e-commerce is expected to improve its experience is by focusing on customer engagement and personalization. Business2Community reports that 63% of millennials state that they actually stay updated on brands via social networks, while another 46% rely on social media when making online purchases. On the personalization end, companies such as TrunkClub and Stitch Fix have led the way in making online shopping more personal by building customer relationships through video consultations and individual relationships between stylists and clients. With these strategies, e-commerce companies are looking to bring the in-store shopping experience into customers’ homes.

Finally, when it comes to e-commerce shipping innovations, “drone” is the hot word on everyone’s mouths, and e-commerce retailers are excited by the possibilities that delivery drones could lead to (in fact, Amazon recently applied for their drone patent, which includes an option for customers to get a delivery to wherever they are at the moment).

However, there are still plenty of issues that need to be worked through before delivery drones become the norm. As a report from the Department of Transportation notes, “Delivery by unmanned aircraft in dense urban environments presents significantly greater security, safety, and privacy risks, and will likely take longer to develop.” Therefore, widespread commercial drone use is likely to stick to tasks such as pipeline inspections and filmmaking, and it will progress first to delivering packages to remote locations before being used in highly populated environments.

The “Amazon effect” has already changed shipping, logistics, employment, and brick-and-mortar stores, and e-commerce shows no signs of slowing down. By understanding the reach of e-commerce, companies can plan their business strategy to take advantage of e-commerce’s significant impact and learn how to provide their customers with what they want- a personalized shopping experience, affordable shipping, and a wide variety of available products.