SEEKING WAYS TO OFFSET RISING RESIN PRICES?

2020-21 HAS SEEN MAJOR SUPPLY CHAIN DISRUPTIONS

Force Majeure!

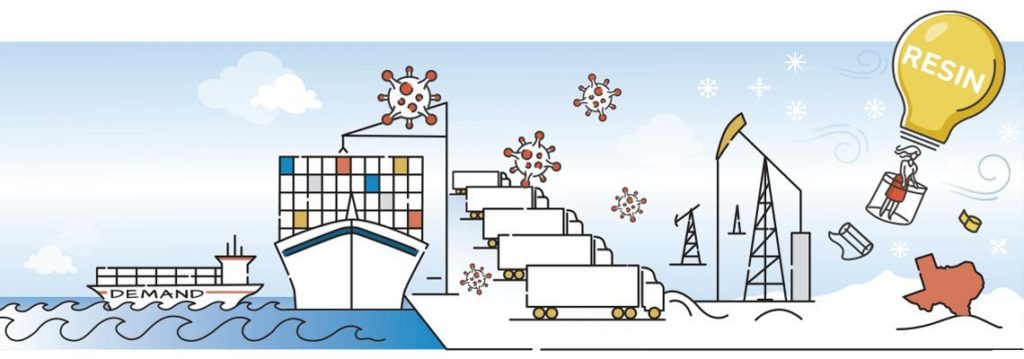

Recent Events from the pandemic to extreme weather have impeded market conditions beyond the control of suppliers and manufacturers, ultimately causing supply chain disruptions and prices of resin raw materials to rise.

2020 PANDEMIC

- Ocean Freight Costs: Rates have increased between 2x-4x since the start of COVID-19*

- Truck Freight Costs: Current truckload cost/mile is up 21% to 44% vs. a year ago*

- Crude Oil Prices: Rise from $20 during quarantine to over $60 a barrel currently; particularly affects PE, PP, and Adhesives raw materials costs**

TEXAS WINTER STORM

- FEB 2021 weather event creates U.S. Chemical Industry supply chain disruption that will last for several months*** At peak of forced shutdowns:

- PP: 57% of the production is down

- PE: 75% of the production is down***

DEMAND

- Pricing trends are being driven by strong demand on North American production due to both our strong economy and exports to Asia, Central America, and South America***

We’re Tracking Polypropylene and Polyethylene Costs

Commodity cost increases, including crude oil needed to manufacture PE and PP, are having an immediate and sharp cost effect on shrink and stretch wrap, films and bags, as well as tapes, labels, and adhesives.

Polyethylene (PE)

- PE pricing for FEB 2021 is 68% higher than JAN 2020****

- Steady and unprecedented increases after initial drop at the onset of COVID-19 — 7 market increases since June 2020****

- PE prices moved up 7¢/lb in FEB 2021, and suppliers issued another 7¢/lb for MAR 2021. These increases are likely to hold because of the Texas storms******

- PE is anticipated to increase another 9¢/lb in APR 2021*******

Polypropylene (PP)

- PP pricing for FEB 2021 is 121% higher than JAN 2020, and 83% higher than it was in NOV 2020****

- At peak FEB 2021 shutdown, almost 90% of U.S. PP resin production was offline*****

- PP prices in FEB 2021 moved up 28¢/lb in step with propylene monomer contracts, which settled at 88.5¢/lb, plus an additional 5¢/lb supplier margin expansion for a whopping total increase of 33¢/lb******

Shorr Has Solutions to Work Around Rising Costs

- STAMP Analysis — a step-by-step procedure identifies “gaps” between your current packaging operations and your goals. We examine all areas of your packaging process to identify areas for packaging optimization.

- Automation — achieve growth and savings through customized automation solutions that will ramp up volume to increase your output and decrease costs per order without adding labor.

- Film Structure Analysis — different film structures and resin blends make significant impacts on cost, performance, structure, yield, and waste. We identify alternatives to improve your output and performance.

We Uncover Savings Where It Makes Sense for You

- Inventory Management + Just-in-Time Programs

- Contract Packaging + Kitting

- Packaging + Material Redesign

- SKU Justification + Rationalization

- Stocking + System Agreements

If we could do any of this for your organization, wouldn’t that be worth a call? 888-885-0055

Sources: *Coronavirus & Shipping: Air and Ocean Freight Delays, Rates & Cost Increases, FreightOS.com, March 12, 2021. ** Debre, Isabel, “Oil giant Saudi Aramco sees 2020 profits drop to $49 billion,” Associated Press, March 21, 2021.

*** Matthews, Christopher M.; Hufford, Austen; Eaton, Collin, “Texas Freeze Triggers Global Plastics Shortage,” The Wall Street Journal, March 17, 2021. ****Intertape Polymer Group, IPG Customer Raw Material Update, Feb. 24, 2021.

***** Resin Makers Still Taking Stock After Texas Storm, Power Outage, OhioRiverCorridor.com, Feb. 26, 2021. ******Sherman, Lilli Manolis, “PP Prices Jump 33¢. Other Volume Resins Up, Too,” Plastics Technology, ptonline.com, March 8, 2021.

*******Shorr Packaging Corp., Industry Expectations, April, 2021.